US Dollar Stablecoins Are A Dual Threat To China

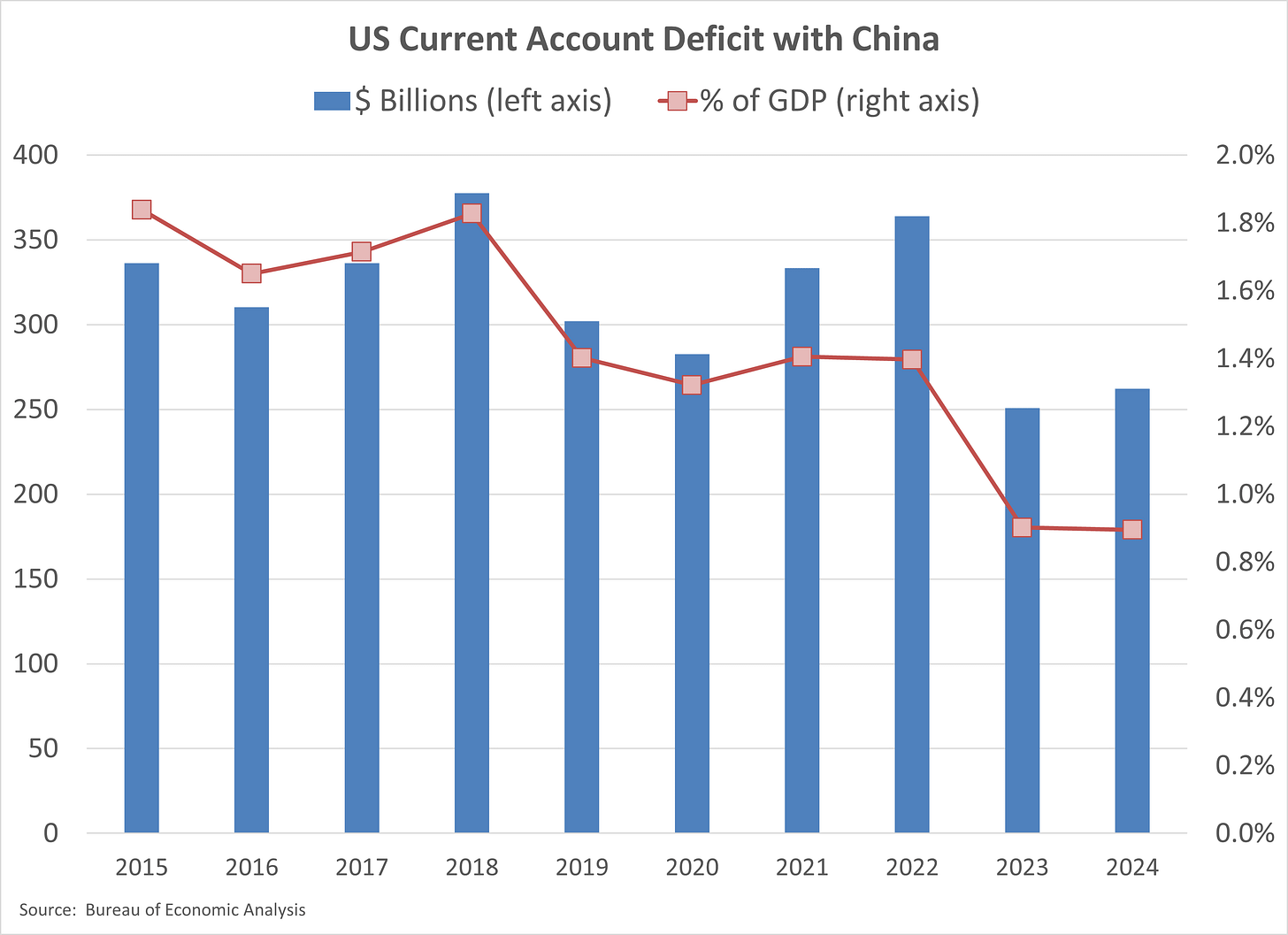

The US current account deficit with China was around $260 billion last year. Trump’s tariffs impose a tax on that economic activity, but they won’t change the basic structure. US deficits with China are not going away.

Two years ago we explored how China uses the dollars it accumulates to support its domestic financial institutions and the foreign acquisition of strategic assets. That conversation was with Zoe Liu, author of the book Sovereign Funds: How the Communist Party of China Finances its Global Ambitions. When I found out that she had spent her summer touring China, talking to company managers and government officials, I asked her back on the show to discuss what she had learned.

She started by providing insight into how the tariff costs are being distributed. The US buys mainly bulk, low-value added items from China. Margins for these types of products are thin. Chinese exporters are therefore not in a position to fully offset the increased tariffs on US companies by lowering prices, because it would wipe out their profits.

However, the total cost to US importers includes both the cost of the goods they buy from Chinese exporters and the shipping fees. Because the US buys LOTS of stuff, it requires lots of shipping and meaningful associated fees. China has invested vast amounts in shipping over the last decade, increasing both its capacity and efficiency. Liu says that while Chinese exporters can’t lower their prices by 15% and remain profitable, they can afford to say something like - “look, we can’t lower our prices, but we can pick up the shipping fees”. Since exporters ship vast amounts, they have leverage with the shipping companies, knowing there is wiggle room in their fees due to increased efficiency. In the end, total costs to US companies have still gone up, but not by the full amount of the tariffs, because some of the pain is being borne by Chinese exporters and shippers. It’s a fascinating example of commercial cooperation happening under the hood of all the headline conflict.

Ok, but what does this all have to do with US dollar stablecoins?

The basic point is that we’re eight years into the tariff regime and the US is still running a current account deficit of $260 billion per year. It has declined relative to the size of the economy, but it’s not going away.

Other things not going away are Chinese capital controls and the system of domestic financial repression. Financial repression means Chinese savers have limited options to invest their money. Interest rates have been kept below inflation, making bank deposits and fixed income unattractive. The stock market has been absurdly volatile with poor long-term returns. That’s left property, which inflated into a bubble and then burst. This creates a huge incentive for savers to invest in other countries. But…capital controls means this is also prohibited.

Still, the golden rule of economics is that people react to incentives. Since there is an incentive to invest internationally, people will find a way. And that’s where USD stablecoins come in. The other theme of Liu’s conversations this summer was the apprehension with which China’s leaders view the potential growth of the USD stablecoin market.

Stablecoins are digital tokens designed to always be worth $1. The Genius Act passed this summer creates a regulatory framework that specifies the assets stablecoin issuers can hold to back their coins. They are all short-term, US dollar-denominated assets backed either explicitly by the US government (Treasury bills) or implicitly (bank deposits, repo transactions, money market funds). Their digital form makes them infinitely divisible, programmable and, most worrying from China’s perspective, anonymous. These features make them potentially very attractive which is precisely what has China worried.

Here’s Liu:

Chinese exporters, they would probably be very open to using dollar-backed stablecoins. Part of the reason is because, well, you lower the international transaction cost. That’s economic motivation.

Then secondly, related to what we were talking about earlier about inflating your export invoices, the idea is rather than going through an underground money laundering system, trying to move your money overseas, now you have a ready-to-go, dollar-backed stablecoin system. That is, you can move your money overseas easily and without the ability of being tracked by the Chinese government.

That loss of monetary sovereignty is worrying but it’s just one issue and this is where the “dual-threat” in this post’s title comes in:

This has a lot to do with the centrality of the party in China’s financial system. Because a pillar of the party’s political power is such that they can control the flow of money and they can also allocate money favorably to sectors or institutions that they consider as more important or more strategic than others. So what dollar-backed stablecoin could potentially disrupt is to displace the party’s centrality in the system.

Of course, that threat that isn’t going to be tolerated, so we can expect a Chinese alternative to compete with USD stablecoins. In fact, China actually had a head start in the digital currency race with its launch of the domestically circulated e-CNY in 2021. But the take-up has been underwhelming. According to a Chinese financial media site “it has fallen into the embarrassing predicament where no one uses it unless there is a promotion.” Liu says the uncertainty around the e-CNY’s future has opened the door for new stablecoin experimentation in Hong Kong, which she sees as China’s “financial laboratory”.

Issuing a renminbi or HKD-backed stablecoin in Hong Kong would allow the token to circulate offshore while keeping mainland capital controls intact. Importantly, the ownership and transaction histories of these coins would be fully traceable. Rather than threaten the CCP’s power as USD stablecoins may, these tokens would cement it. The CCP would have the ability to issue money with expiration dates, sector-specific spending limits, geographic restrictions - really anything you can imagine. In Liu’s words:

In this framework, stablecoins are not a gateway to financial freedom - they are a platform for programmable sovereignty, both at home and abroad.

Learn more about the coming next stage of US/China co-dependency and competition by listening to my conversation with Zoe Liu on Top Traders Unplugged Ideas Lab podcast series:

Spotify:

Apple Podcasts:

You Might Also Like

How China Manages Trillions In Shadow Reserves

Targeted Algorithms Influence Our Thoughts, Feelings and Behaviors.