Do Ultra-Low Rates Cause Ultra-Low Growth?

Without interest, there is no capital. Without capital, no capitalism.

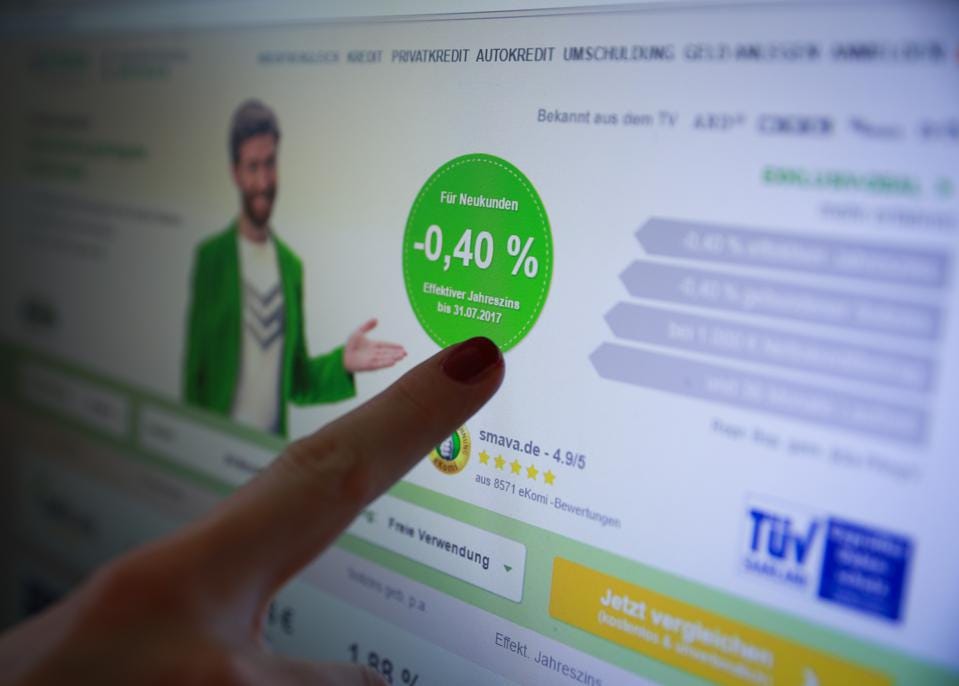

When I picked up Edward Chancellor’s new book I was expecting a history of interest rates. And I definitely got that - from a Babylonian named Gugish borrowing 13 years worth of barley at 33% in 2,400 BC (Gugish - shop around a bit mate), to Danish home buyers being paid to borrow in 2016.

I wasn’t expecting was a detailed exposition of all the ways the ultra-low interest rates since 2008 may have caused poor economic growth. In some ways it felt like two books.

The first is an historical review of the idea of interest. Is it the price of credit? risk? need? control? Or is it the price of time - a bridge that connects the present to the future? The second places the last 15 years of history under the microscope and claims that the medicine of low rates is harming the economic patient.

If you want a better feel for these ideas, I briefly review the main points in my Forbes article. If you want more, Chancellor elaborates with some fascinating stories during our discussion on Top Traders Unplugged:

Brief review of The Price Of Time for Forbes

My interview with Edward Chancellor on Top Traders Unplugged

All the best,

Kevin

You Might Also Like:

Can Economists Learn From The Boston Celtics?

Reasons To Be Optimistic About The Economy And The Environment